NetSuite and 1C

1C – What’s this?

1C is low-price accounting software that:

- Is used among 90%-95% of companies in Kazakhstan, Uzbekistan, Moldova more then 75% of companies in Ukraine for TAX accounting and general accounting

- supports all legislation Accounting and Tax rules for these countries

- have built-in integration for bank-client systems

Why NetSuite and 1C ?

- Solves all local compliance issues and meet all legislation requirements for Local Accounting Principles and TAX accounting.

- Meet Personal Data storage law requirements. Law is saying that personal data storage must be on local territory. NetSuite and 1C scheme can solve this requirement, because for transactions with personal data 1C can be the personal data storage.

What we propose

NetSuite and 1C Connector

Online Transactions synchronization between NetSuite and 1C:

- after Create, Edit or Delete of transaction

- Bidirectional: from NetSuite to 1C, from 1C to NetSuite

- Direction setup per Transaction Type

- On document (transaction) level, not Journal Entry level. After transaction transfer to another system it will be processed by system standard engine (NetSuite or 1C) and journal entry will be created

Type of transactions for synchronization:

|

|

Type of records for synchronization:

|

|

- Payroll Payments

- Payroll taxes

- Other company taxes – accruals and payments

- Expense Reports

- Address verification

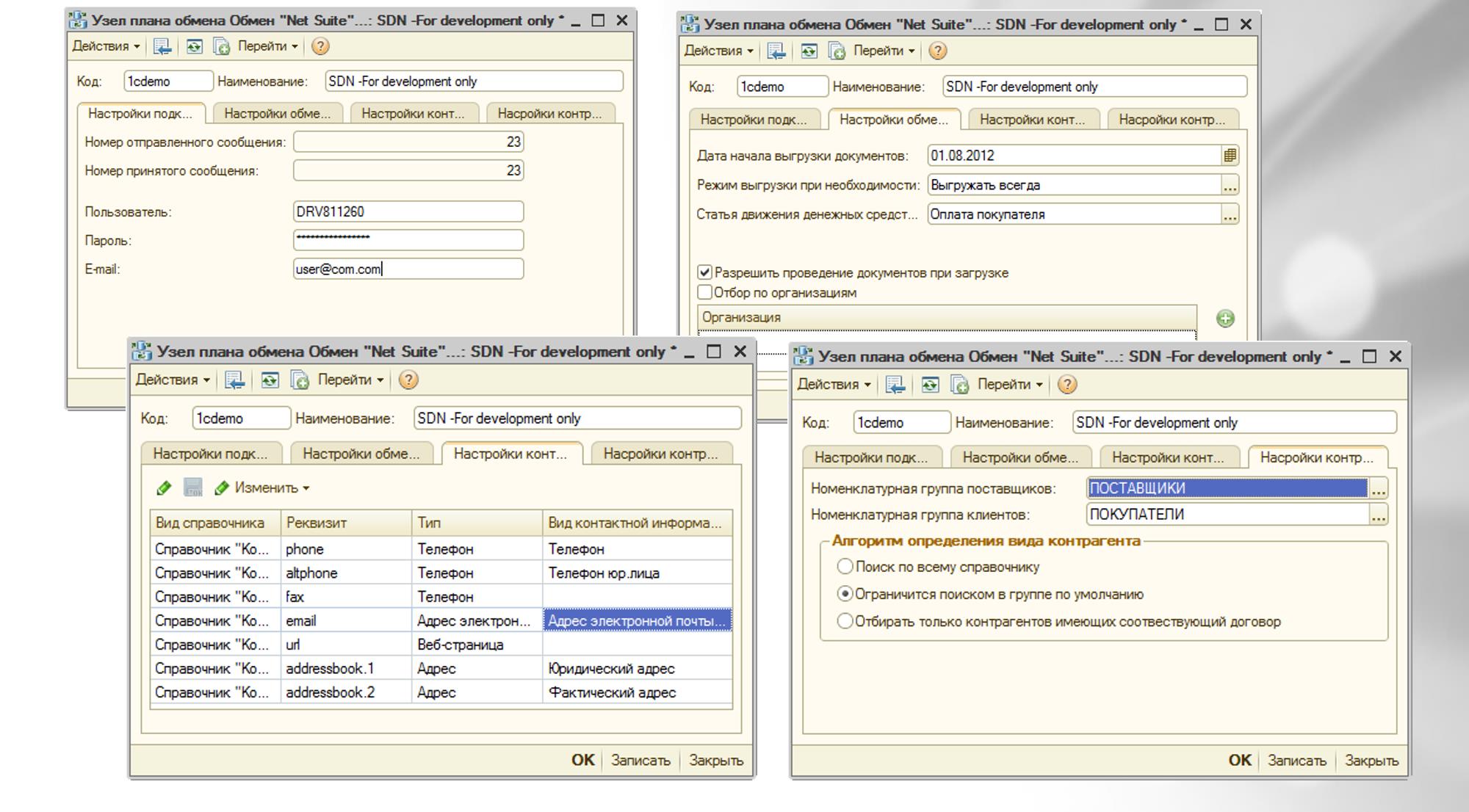

Connector Setup

Initial Implementation:

- References mapping (Customers, Vendors, etc.)

- Object fields mapping

- Transfer direction for each transaction type

- Additional transfer conditions